PRP Service understands that today’s banking customers expect quick responses, secure communication, and convenient service on platforms they already use every day. Long wait times on phone calls, delayed emails, and complicated support processes can often frustrate customers. People now want instant updates, fast assistance, and reliable information without extra effort. WhatsApp has become a go-to choice for banking because it’s a platform people already know and trust.

By using the WhatsApp API, banks can provide instant support, automate routine tasks, and send out important alerts the moment they happen. It’s a win-win: customers get faster answers on an app they love, while banks save time and cut down on paperwork—all without compromising on security.

WhatsApp API For Banking is a secure communication solution that lets banks connect with customers using the official WhatsApp Business API. It allows automatic and two-way messaging so customers can receive account notifications, transaction alerts, ask questions, and get service updates quickly.

Unlike the regular WhatsApp Business App, the API is designed for enterprise-level, high-volume communication. It supports automation, chatbot integration, multi-agent access, and system connectivity. This allows banks to manage thousands of conversations simultaneously while maintaining data privacy, message accuracy, and policy compliance. Banks can provide professional, reliable communication without depending entirely on call centers.

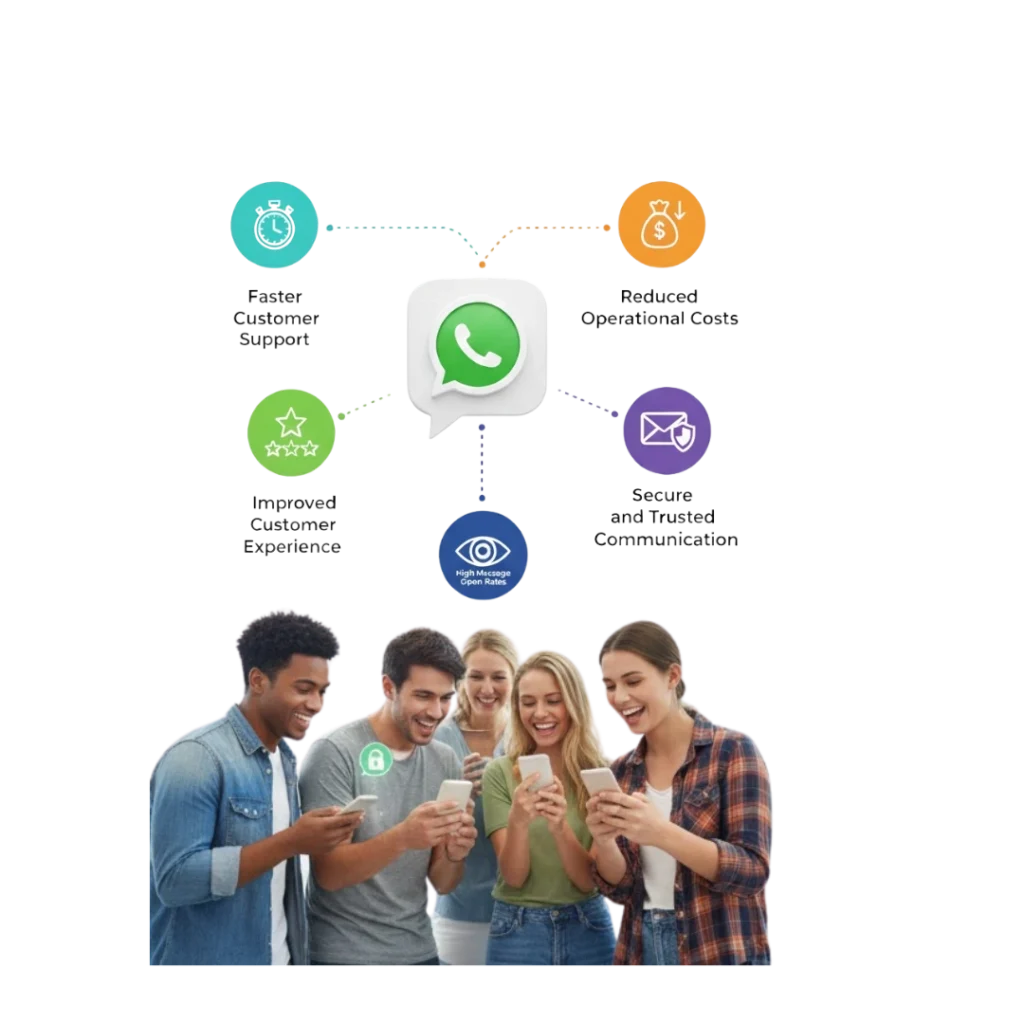

Using WhatsApp API For Banking helps banks boost customer engagement while reducing operational workload and costs. It provides faster responses, better message visibility, and 24/7 communication on a platform customers already trust.

- Faster Customer Support: Customers get instant replies to common queries such as balance info, service updates, and account notifications, cutting down wait times.

- Improved Customer Experience: Banks can provide quick, clear, and personalized communication to make customers feel valued and informed.

- Reduced Operational Costs: Automation of common queries and alerts reduces call center loads and manual work.

- Secure and Trusted Communication: Built on the official WhatsApp Business API, all messages meet strict security and compliance standards.

- High Message Open Rates: WhatsApp messages are read more often than emails or SMS, ensuring important banking updates reach customers on time.

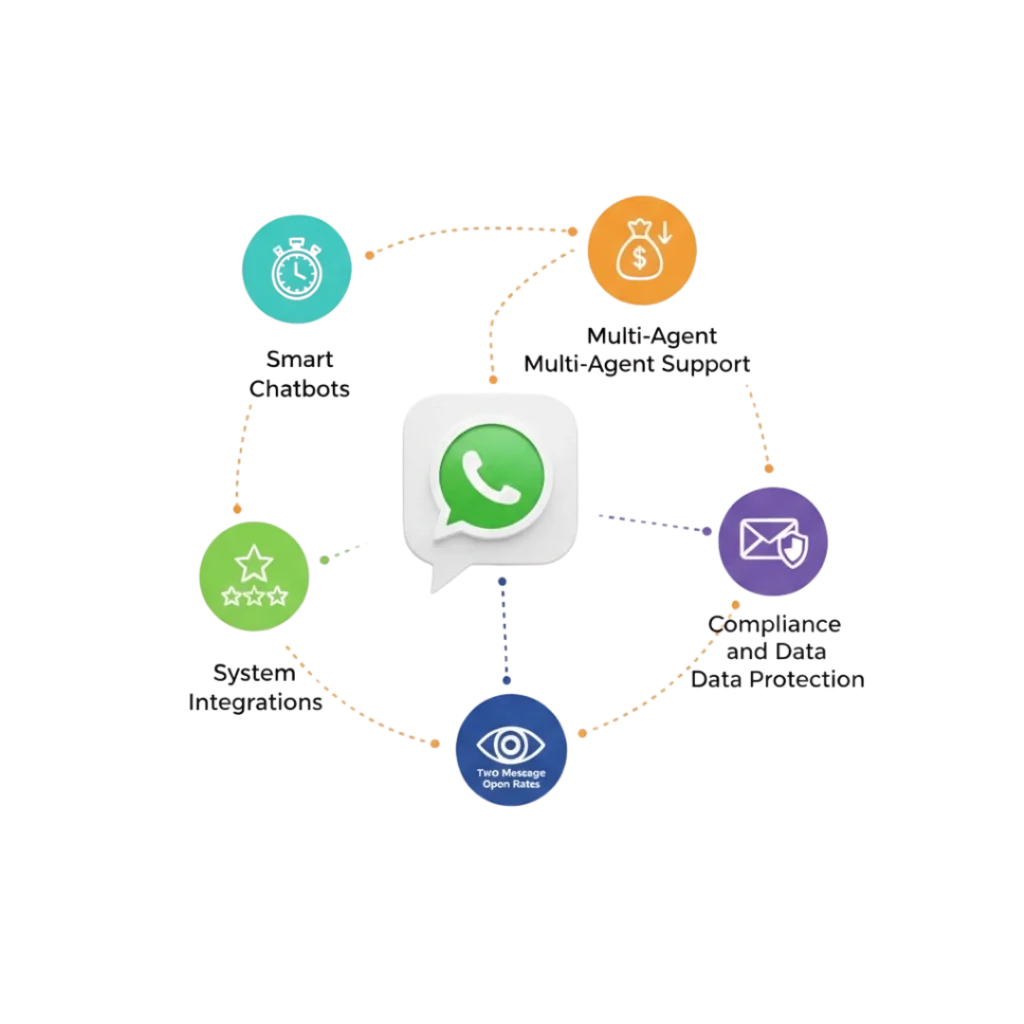

WhatsApp API For Banking offers features that help banks communicate quickly, securely, and efficiently. These tools are built to handle thousands of messages at once without losing that personal touch. They keep things running smoothly for customers while ticking all the boxes for banking security and regulations.

- Smart Chatbots: Think of these as digital assistants that never sleep. They instantly handle common questions about account balances, branch locations.

- Multi-Agent Support: Multiple agents can manage conversations from a single WhatsApp number via shared dashboards.

- System Integrations: The API connects smoothly with core banking systems, CRMs, ERPs, payment platforms, and customer support tools for seamless operations.

- Two-Way Communication: Customers can respond, ask questions, and receive immediate assistance securely.

- Compliance and Data Protection: Built on Meta-approved WhatsApp Business API, ensuring privacy, security, and compliance with banking regulations.

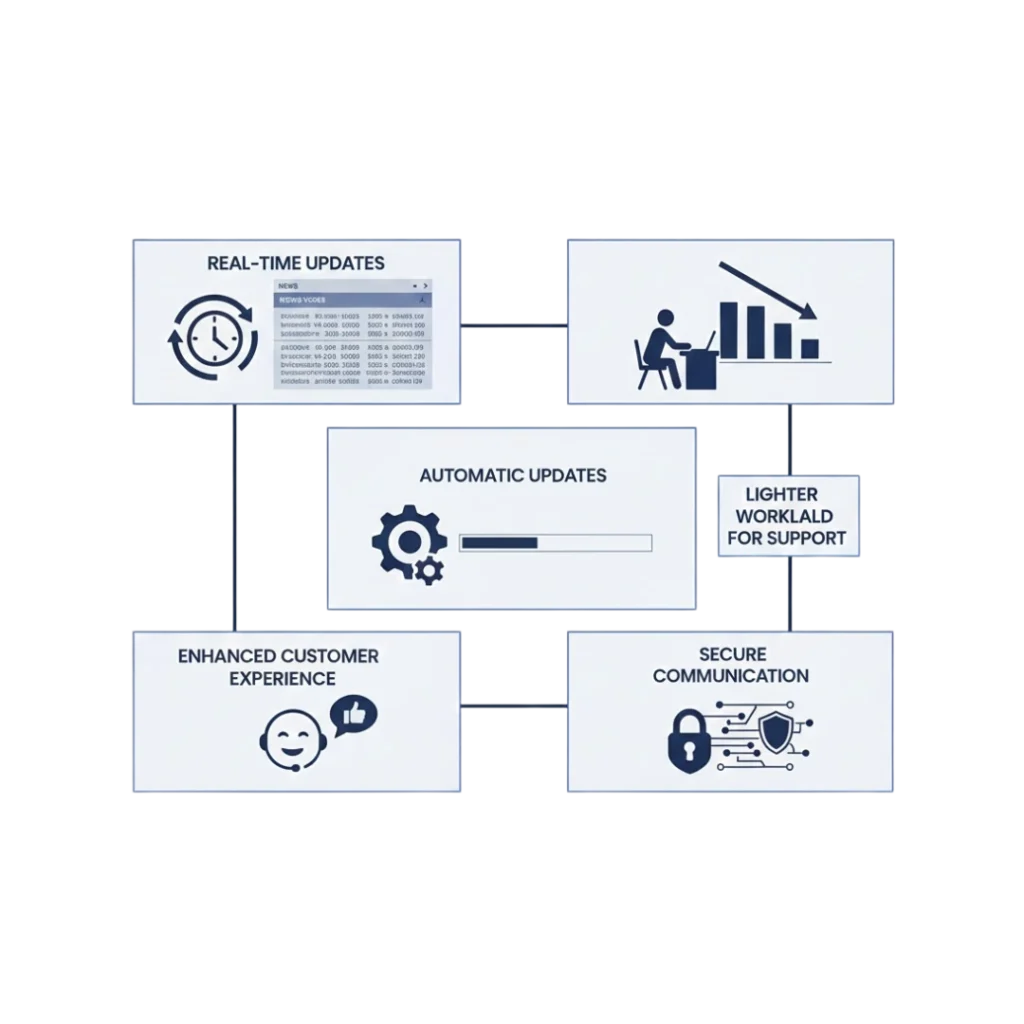

In today’s digital-first environment, customers expect banks to communicate quickly, securely, and conveniently. WhatsApp API For Banking matters because it lets banks connect with customers instantly on a platform they already trust.

- Real-Time Updates: Transaction alerts, balance info, and reminders reach customers immediately, keeping them informed.

- Enhanced Customer Experience: At the end of the day, it’s all about making life easier for the customer. Instead of jumping through hoop.

- Automatic Updates: Whether it’s a payment reminder, a one-time password (OTP), or a quick account update, these messages go out automatically.

- Lighter Workload for Support: By letting automation handle the basics, your call center isn’t flooded with simple questions.

- Secure Communication: Every conversation is protected with strong encryption, keeping sensitive financial data private and meeting strict banking security standards.

PRP Service provides secure, scalable, and fully customized WhatsApp API For Banking solutions customized to financial institutions.

Banking Solutions

WhatsApp API For Banking offers tailored solutions to meet the unique needs of banks and financial institutions.

Official WhatsApp

PRP Service manages the complete WhatsApp Business API setup and onboarding process for banks.

Security-First

In banking, protecting customer data and maintaining compliance is critical. A security-first approach ensures that every message.

Scalable Performance

As more customers interact, the platform can manage higher message volumes without slowing down or affecting performance.

WhatsApp API For Banking is now a vital tool for modern banks looking to communicate faster, deliver better service, and operate efficiently. Today’s customers expect instant updates, quick support, and simple digital interactions. With WhatsApp API, banks can instantly send transaction alerts, balance updates, payment reminders, and important announcements to their customers. This keeps communication fast, reduces frustration, and stays fully secure.

By working with PRP Service, banks get a safe, reliable, and fully customized WhatsApp API solution. PRP Service helps automate everyday conversations, reduce manual work, and provide 24/7 support for a smooth customer experience. WhatsApp API For Banking becomes more than just a messaging tool—it’s a smart communication channel that supports digital transformation, strengthens customer trust, and drives long-term business growth.

Fill out the form to get a secure, customized WhatsApp API solution for your bank. Automate notifications, improve customer support, and deliver real-time updates instantly.

It is a secure messaging solution that lets banks communicate with customers using the official WhatsApp Business API. It supports automated alerts, transaction updates, and customer queries.

It allows banks to provide instant replies, real-time updates, and 24/7 support, improving customer experience and reducing wait times.

Yes, it uses end-to-end encryption and follows strict security and compliance standards to protect sensitive customer information.

Banks can automate transaction alerts, payment reminders, OTPs, account updates, FAQs, and other routine communications.

PRP Service provides a fully customized, secure, and reliable solution with 24/7 support, automation of routine tasks, and smooth integration with banking systems.