The financial industry thrives on trust, speed, and security. Customers expect instant updates, seamless communication, and safe transactions at every step of their journey. Whether it’s checking account balances, receiving loan approvals, paying insurance premiums, or tracking investments, timely and accurate communication is critical. If you’re a bank, insurance provider, fintech startup, or loan company, you already understand how essential it is to stay connected with your customers and provide them with a smooth, reliable experience.

This is where the WhatsApp Business API can truly transform your communication strategy. Unlike traditional channels like email or phone calls, WhatsApp allows you to send instant messages, share important updates, and even respond to customer queries automatically.

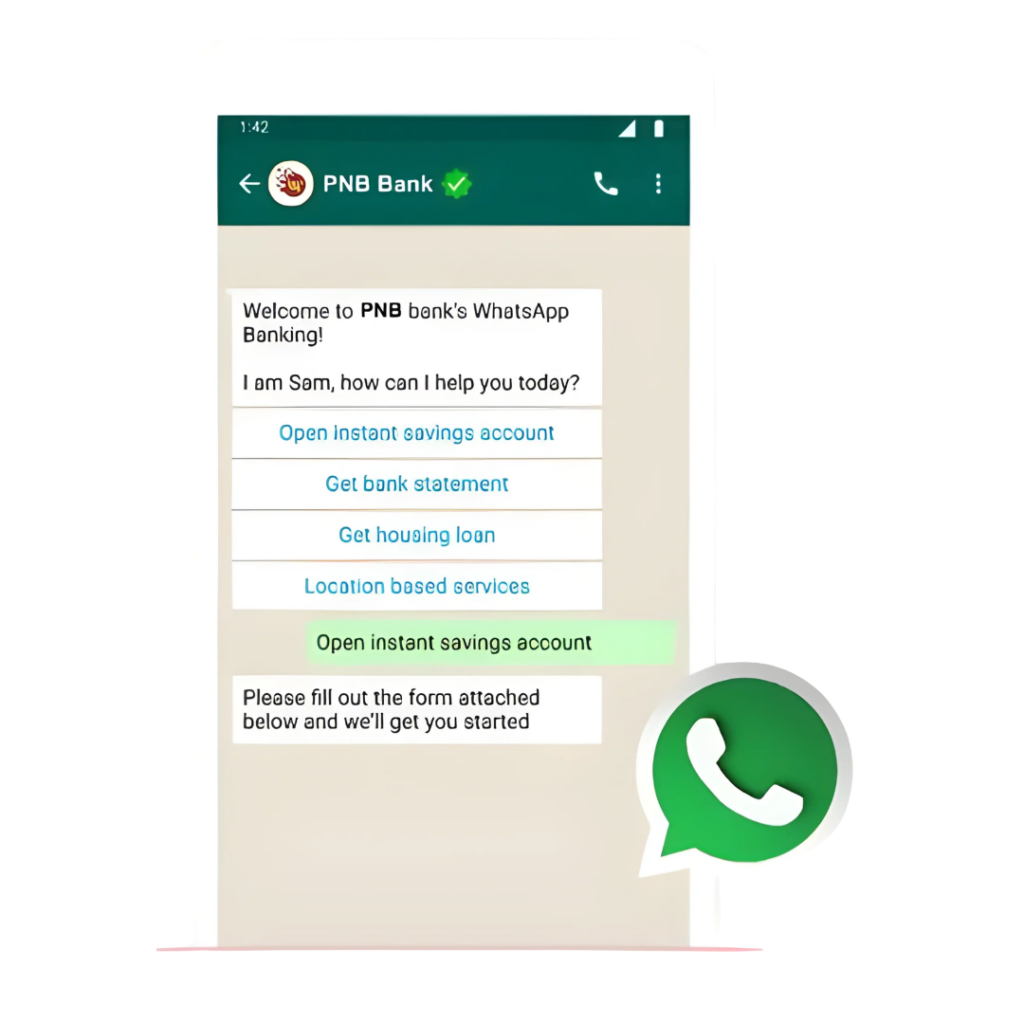

The WhatsApp Business API is a professional communication solution designed for medium and large businesses, helping them manage customer communication more efficiently and at scale. Unlike the free WhatsApp Business app, the API allows for two-way messaging, so businesses can send messages and customers can reply directly, creating a smooth conversation flow. It also supports automation and chatbots, allowing instant answers to frequently asked questions any time of the day. Sensitive documents such as account statements, KYC forms, or loan agreements can be shared securely, while pre-approved message templates make sending important notifications like payment reminders, OTPs, or alerts fast.

Financial services rely on speed, trust, and accuracy. Here’s why WhatsApp Business API is perfect for this industry:

- High Open Rates: WhatsApp messages have more than 90% open rates, much higher than email.

- Faster Response Times: Customers usually reply to WhatsApp messages within minutes.

- End-to-End Encryption: Keeps sensitive financial data secure.

- Better Customer Experience – Real-time conversations build trust and loyalty.

- Lower Support Costs: Chatbots handle repetitive queries, reducing call center load.

- 24/7 Availability: Customers can get help anytime, even on weekends or holidays.

The WhatsApp Business API is extremely versatile. Here are some of the most popular use cases in the financial industry:

Customer Support

WhatsApp Business API makes customer support quick and easy. Customers can ask about balance, loans, policies, or account opening.

Payment Reminders

Sending payment reminders is simple on WhatsApp. Businesses can remind customers about EMIs, bills, or premiums and even add a payment link.

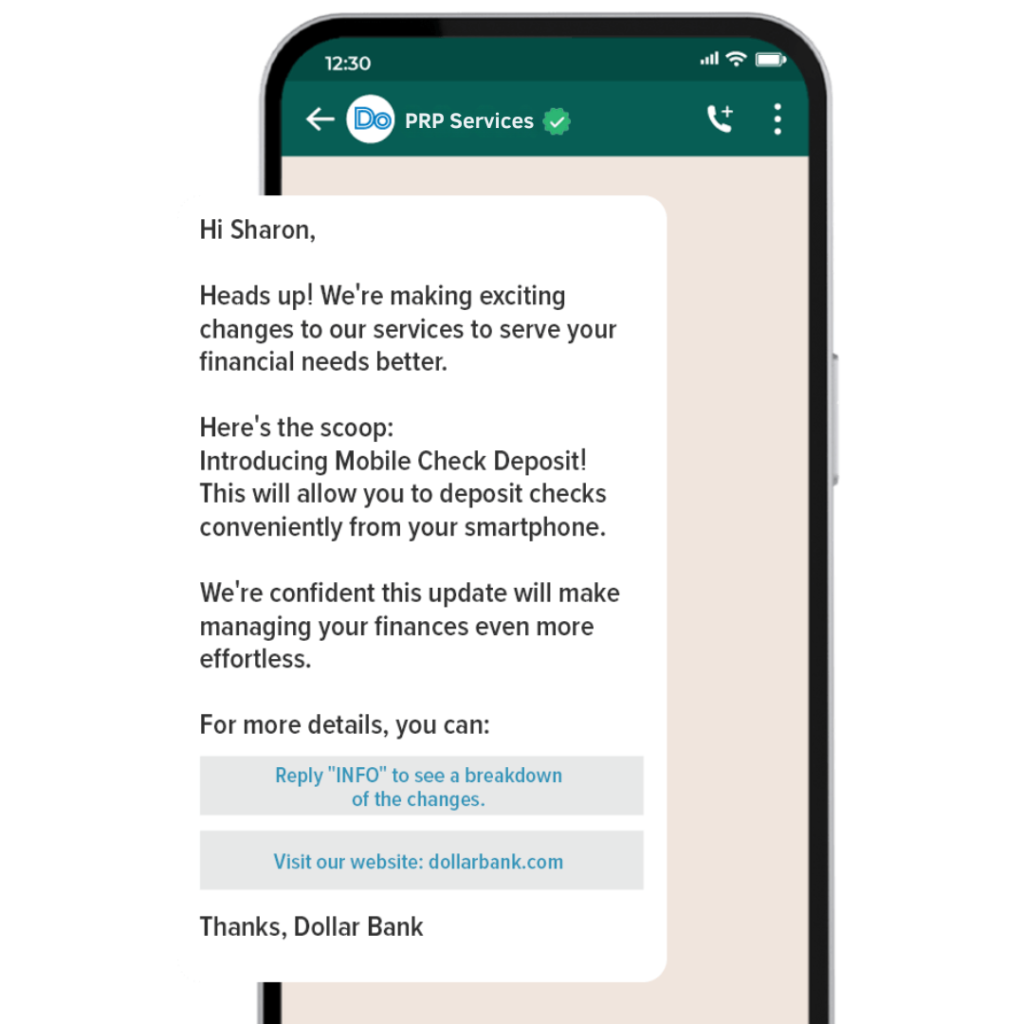

Notifications

With WhatsApp, customers get instant updates on transactions, suspicious activity, loan approvals, or account changes. This builds trust.

Lead Generation

Click-to-WhatsApp ads let customers start a chat directly. Businesses can collect details, share brochures.

Secure Document Collection

Customers can easily send KYC or income proof via WhatsApp, saving time and avoiding branch visits.

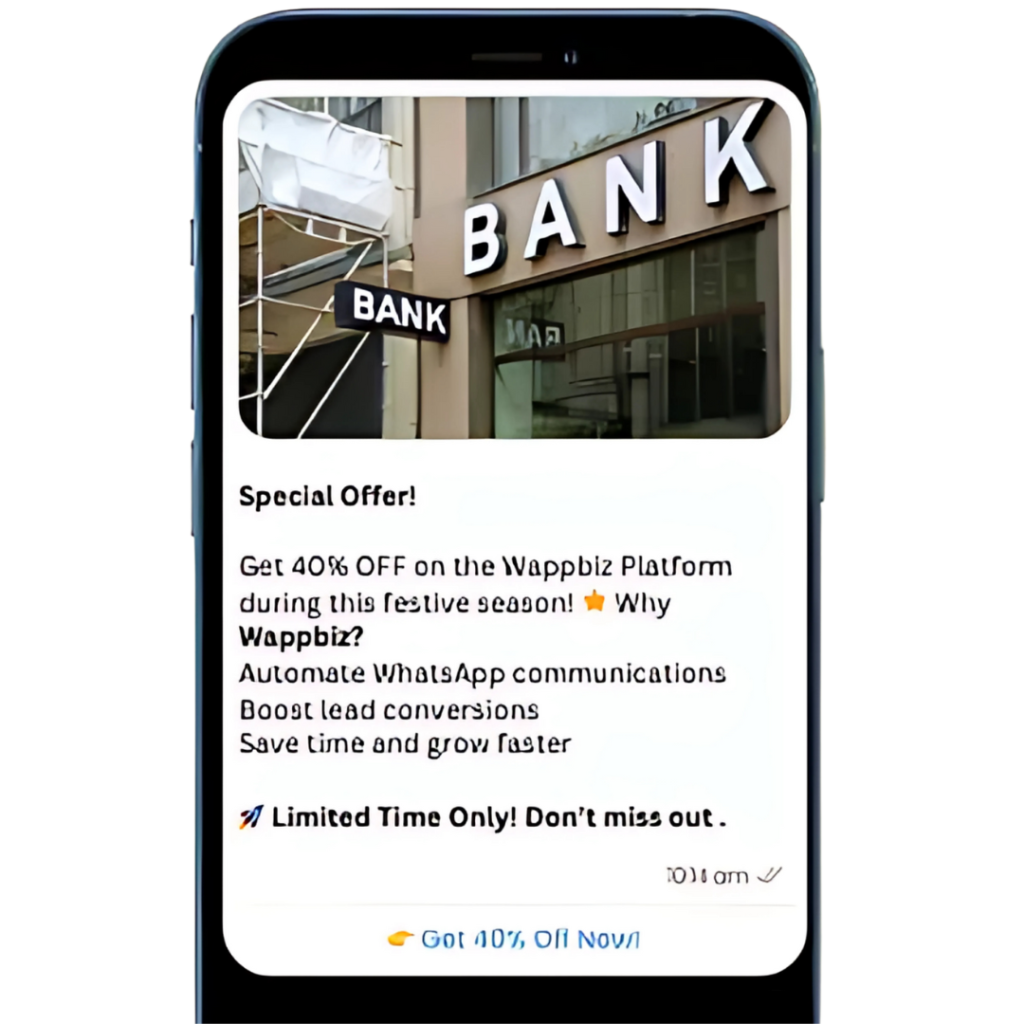

Marketing Campaigns

Financial companies can send tailored offers like credit card upgrades, loan top-ups, and investment suggestions.

Adopting WhatsApp Business API offers several advantages:

- Enhanced Customer Experience: Quick responses and instant updates create a smooth journey.

- Higher Engagement: Customers are more likely to read and reply to WhatsApp messages.

- Efficiency & Automation: Reduce manual work and save time with automated workflows.

- Fraud Prevention: Secure messaging helps verify customer identity and protect data.

- Cost Savings: Fewer phone calls mean reduced call center costs.

- More Conversions: Easier communication increases the chances of completing applications or payments.

To get the best results, follow these tips:

- Use WhatsApp-Approved Templates: This ensures message delivery and compliance.

- Keep It Short & Clear: Write simple messages that are easy to understand.

- Personalize Messages: Use customer names and relevant details.

- Respect Privacy & Compliance: Follow KYC, GDPR, and RBI guidelines.

- Offer Opt-Out: Give customers an easy way to unsubscribe if they don’t want messages.

- Integrate with CRM & Analytics: Track interactions and measure results for better campaigns.

Why Choose PRP Services for WhatsApp Business API

At PRP Services Pvt Ltd, we make WhatsApp Business API setup and management simple for financial service providers.

The WhatsApp Business API for financial services is not just a simple chat tool — it’s a powerful communication platform that can transform the way financial institutions connect with their customers. It allows banks, insurance companies, and fintech businesses to deliver real-time updates, send secure reminders, collect documents, and even onboard new customers with ease. By combining automation with a personal touch, it ensures every customer feels valued and informed.

Whether it’s improving payment collections, sending instant alerts, or running personalized marketing campaigns, WhatsApp Business API helps you create a smooth and reliable customer experience. This not only boosts customer satisfaction but also builds long-term trust and loyalty.