Automated call handling (ACH), also known as interactive voice response (IVR), is a technology that uses automated systems to handle incoming phone calls. These systems can interact with callers using voice prompts, allowing them to navigate through a menu of options or provide specific information without the need for human intervention.

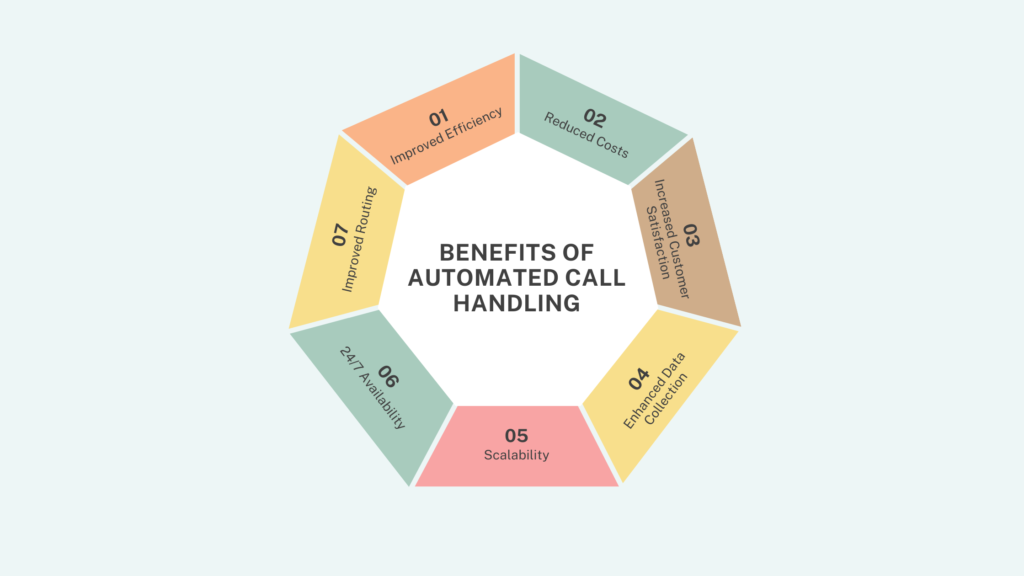

ACH systems have become increasingly prevalent in businesses of all sizes, as they offer several benefits such as:

- Improved Efficiency: ACH systems can handle a large volume of calls simultaneously, reducing wait times for callers and freeing up human agents to focus on more complex issues.

- Reduced Costs: By automating routine tasks, ACH can help businesses save on labor costs and improve overall operational efficiency.

- Increased Customer Satisfaction: ACH systems can provide consistent and accurate information to callers, improving their overall experience and satisfaction.

- Enhanced Data Collection: ACH systems can capture valuable data about caller interactions, which can be used to improve business processes and marketing efforts.

- Scalability: ACH systems can easily be scaled up or down to meet changing business needs, making them a flexible solution for businesses of all sizes.

- 24/7 Availability: ACH systems can operate 24 hours a day, 7 days a week, ensuring that customers can always reach your business.

- Improved Routing: ACH systems can intelligently route calls to the appropriate agents or departments based on the caller’s needs, reducing handling time and improving customer satisfaction.

Key Features of Automated Call Handling (ACH) Systems

Automated call handling (ACH) systems offer a wide range of features that can be Customized to meet the specific needs of your business. Here are some of the key features to consider

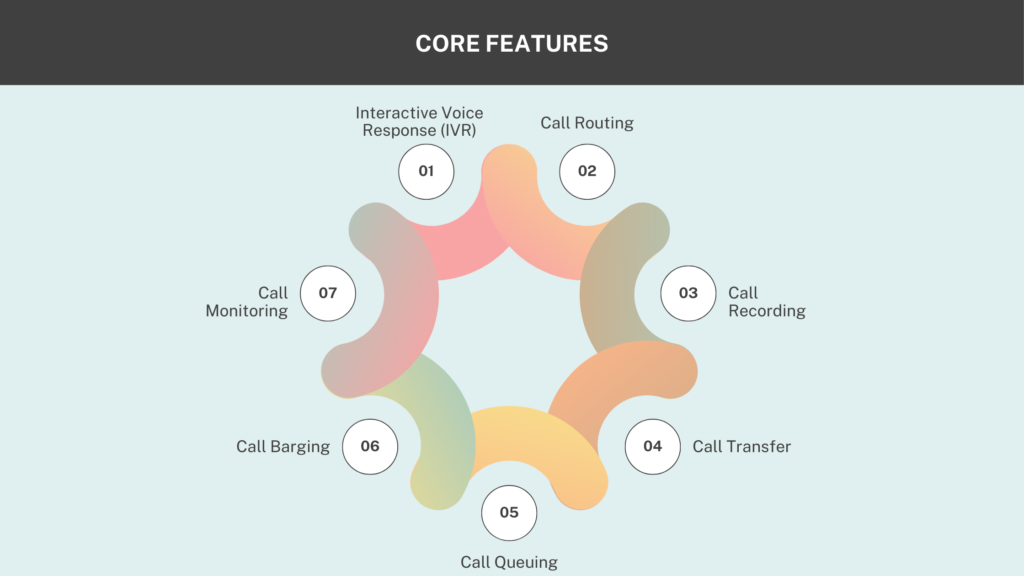

Core Features

- Interactive Voice Response (IVR): Allows callers to navigate through a menu of options using voice prompts, reducing the need for human interaction.

- Call Routing: Automatically routes calls to the appropriate agents or departments based on the caller’s needs, improving efficiency and reducing wait times.

- Call Recording: Records all incoming and outgoing calls for quality assurance, compliance, and training purposes.

- Call Transfer: Allows agents to transfer calls to other agents or departments within the organization.

- Call Queuing: Manages incoming calls that cannot be answered immediately, placing them in a queue and providing callers with estimated wait times.

- Call Barging: Allows supervisors to listen in on agent calls to provide assistance or monitor performance.

- Call Monitoring: Tracks agent performance metrics, such as average handling time and first call resolution rate.

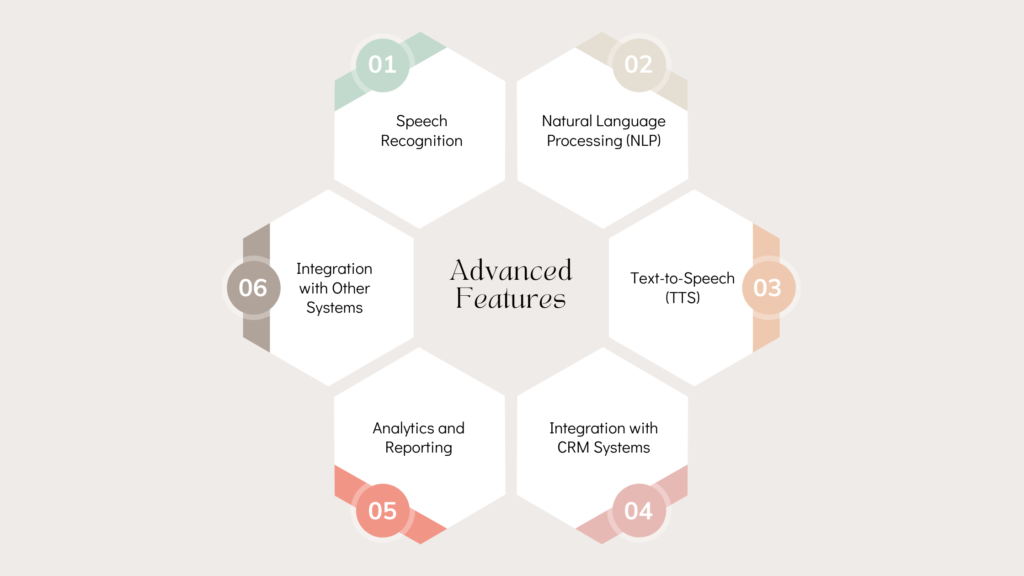

Advanced Features

- Speech Recognition: Enables ACH systems to recognize and understand spoken language, allowing callers to provide information or request services verbally.

- Natural Language Processing (NLP): Allows ACH systems to interpret and respond to complex language patterns, providing more intelligent and natural interactions.

- Text-to-Speech (TTS): Converts text into spoken language, allowing ACH systems to provide information or instructions in a more human-like voice.

- Integration with CRM Systems: Integrates with customer relationship management (CRM) systems to provide a seamless customer experience and access to customer data.

- Analytics and Reporting: Provides detailed analytics and reporting on call center performance, allowing businesses to identify areas for improvement.

- Integration with Other Systems: Integrates with other business systems, such as ERP and accounting systems, to streamline processes and improve efficiency.

Upcoming Features

As technology continues to evolve, we can expect to see even more advanced features in automated call handling (ACH) systems in the near future. Here are some of the upcoming trends to watch:

- Enhanced Natural Language Processing (NLP): AI-powered NLP will enable ACH systems to have more natural and engaging conversations with callers, better understanding their intent and providing more accurate responses.

- Sentiment Analysis: AI algorithms can analyze the tone and emotion in a caller’s voice, allowing ACH systems to identify and address potential issues or concerns.

- Predictive Routing: AI can predict the best agent or department to handle a call based on the caller’s history, preferences, and the nature of the inquiry.

- AI-Driven Call Summarization: ACH systems can automatically summarize the key points of a call, providing agents with a concise overview before the call is transferred.

- Omnichannel Integration: ACH systems will become more integrated with other communication channels, such as chatbots, email, and social media, providing a seamless customer experience across all platforms.

- Advanced Analytics and Reporting: AI-powered analytics tools will offer more sophisticated insights into call center performance, helping businesses to identify trends and optimize operations.

- Biometric Authentication: ACH systems may incorporate biometric authentication methods, such as voice or facial recognition, to enhance security and improve the customer experience.

- Integration with IoT Devices: ACH systems could be integrated with IoT devices to provide proactive customer support and address issues before they escalate.

- Virtual Agents: AI-powered virtual agents may be able to handle more complex customer inquiries, reducing the need for human intervention.

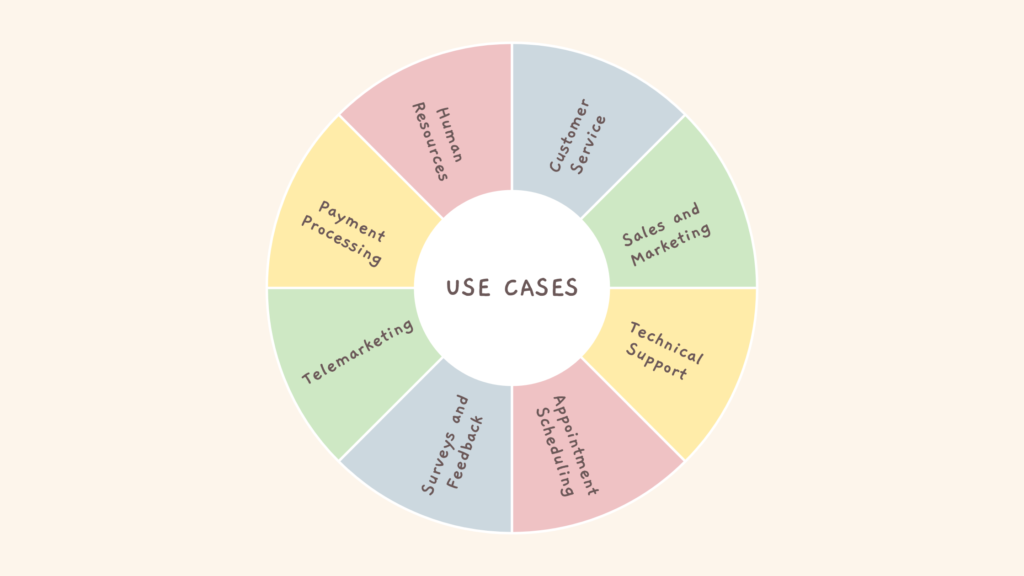

Use Cases for Automated Call Handling (ACH)

Automated call handling (ACH) systems can be used in a wide variety of industries and applications. Here are some common use cases:

- Customer Service: ACH systems can handle routine customer inquiries, such as account balance checks, password resets, and order status updates, freeing up human agents to focus on more complex issues.

- Sales and Marketing: ACH systems can be used to generate leads, schedule appointments, and follow up with potential customers.

- Technical Support: ACH systems can provide basic troubleshooting assistance and direct callers to appropriate resources for more complex issues.

- Appointment Scheduling: ACH systems can be used to schedule appointments for various services, such as medical appointments, customer support calls, or sales consultations.

- Surveys and Feedback: ACH systems can be used to conduct surveys and collect customer feedback, providing valuable insights into customer satisfaction and preferences.

- Telemarketing: ACH systems can be used to automate outbound calls for telemarketing campaigns, improving efficiency and reducing costs.

- Payment Processing: ACH systems can be used to process payments and handle customer inquiries related to billing and invoicing.

- Human Resources: ACH systems can be used to automate tasks such as employee onboarding, time off requests, and benefits inquiries.

Case Study: Improving Customer Satisfaction with ACH

A large telecommunications company was struggling to keep up with the increasing volume of customer calls. Long wait times and inconsistent service were leading to customer dissatisfaction and churn.

To address these issues, the company implemented an ACH system that could handle routine customer inquiries and route more complex calls to human agents. The ACH system also provided detailed analytics on call center performance, allowing the company to identify areas for improvement.

Within a few months of implementing the ACH system, the company saw a significant improvement in customer satisfaction. Wait times were reduced, and customers were able to get the information they needed more quickly and efficiently. Additionally, the analytics provided by the ACH system helped the company to identify and address training gaps among its agents, further improving the quality of customer service.

As a result of the successful implementation of ACH, the company was able to reduce customer churn and improve its overall reputation.

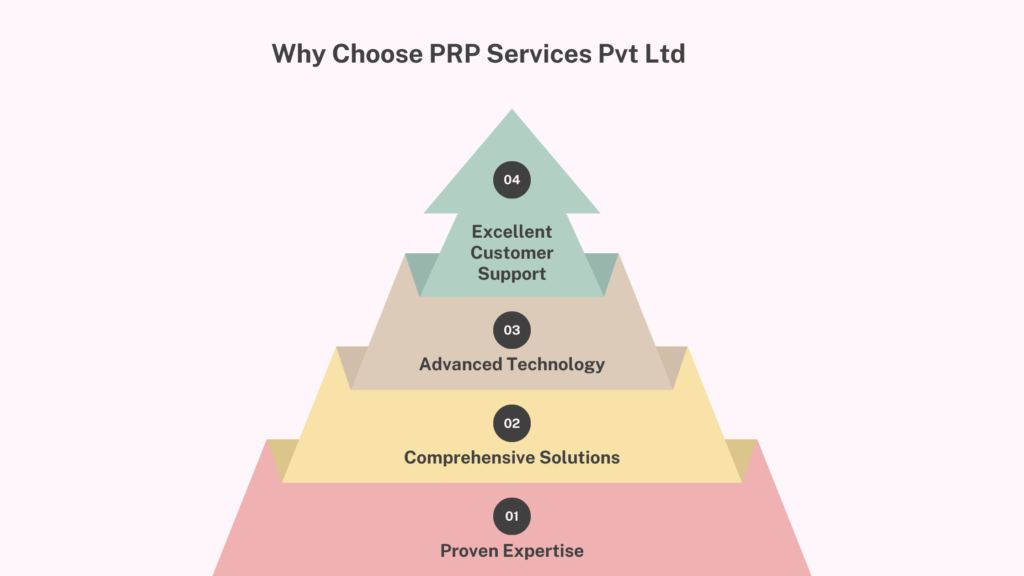

Why Choose PRP Services Pvt Ltd for Your Automated Call Handling Needs

PRP Services Pvt Ltd is a leading provider of automated call handling (ACH) solutions, offering a wide range of features and benefits to businesses of all sizes. Here’s why you should choose PRP Services for your ACH needs:

Proven Expertise

- Years of Experience: PRP Services has a long history of providing innovative ACH solutions to businesses across various industries.

- Industry Knowledge: Our team of experts has a deep understanding of the latest trends and technologies in the field of automated call handling.

- Customer-Centric Approach: We are committed to delivering exceptional customer service and ensuring that our solutions meet your specific needs.

Comprehensive Solutions

- Customized Solutions: PRP Services can design and implement ACH systems that are tailored to your unique business requirements.

- Scalability: Our solutions can be easily scaled up or down to meet your changing needs.

- Integration Capabilities: We can integrate your ACH system with other business systems, such as CRM and ERP, to provide a seamless customer experience.

Advanced Technology

- Latest Features: PRP Services utilizes the latest AI and machine learning technologies to provide advanced features such as natural language processing, sentiment analysis, and predictive routing.

- Cloud-Based Solutions: Our ACH systems are cloud-based, offering flexibility, scalability, and reduced maintenance costs.

- Security and Reliability: We prioritize data security and reliability, ensuring that your customer data is protected and your ACH system operates smoothly.

Excellent Customer Support

- Dedicated Support: Our team of experts is available to provide ongoing support and assistance throughout the implementation and operation of your ACH system.

- 24/7 Support: We offer 24/7 technical support to ensure that your ACH system is always up and running.

- Customization: We can customize our support services to meet your specific needs and preferences.

Upgrade Your Call Handling with PRP Services!

Enhance efficiency, cut costs, and improve customer satisfaction with PRP Services' advanced ACH solutions. Contact us today to see how we can streamline your customer interactions

Click Here